Equipment Finance with CASEY

Fast approvals and a simple process — no deposit options, 7-year terms, and 24-hour approvals.

Getting equipment finance can be stressful - we keep it simple.

100% free • No credit score impact

🏆 Lenders’ Choice Broker of the Year Finalist (Optimise 2025)

Our Panel of 40+ Lenders

Why businesses choose CASEY for equipment finance

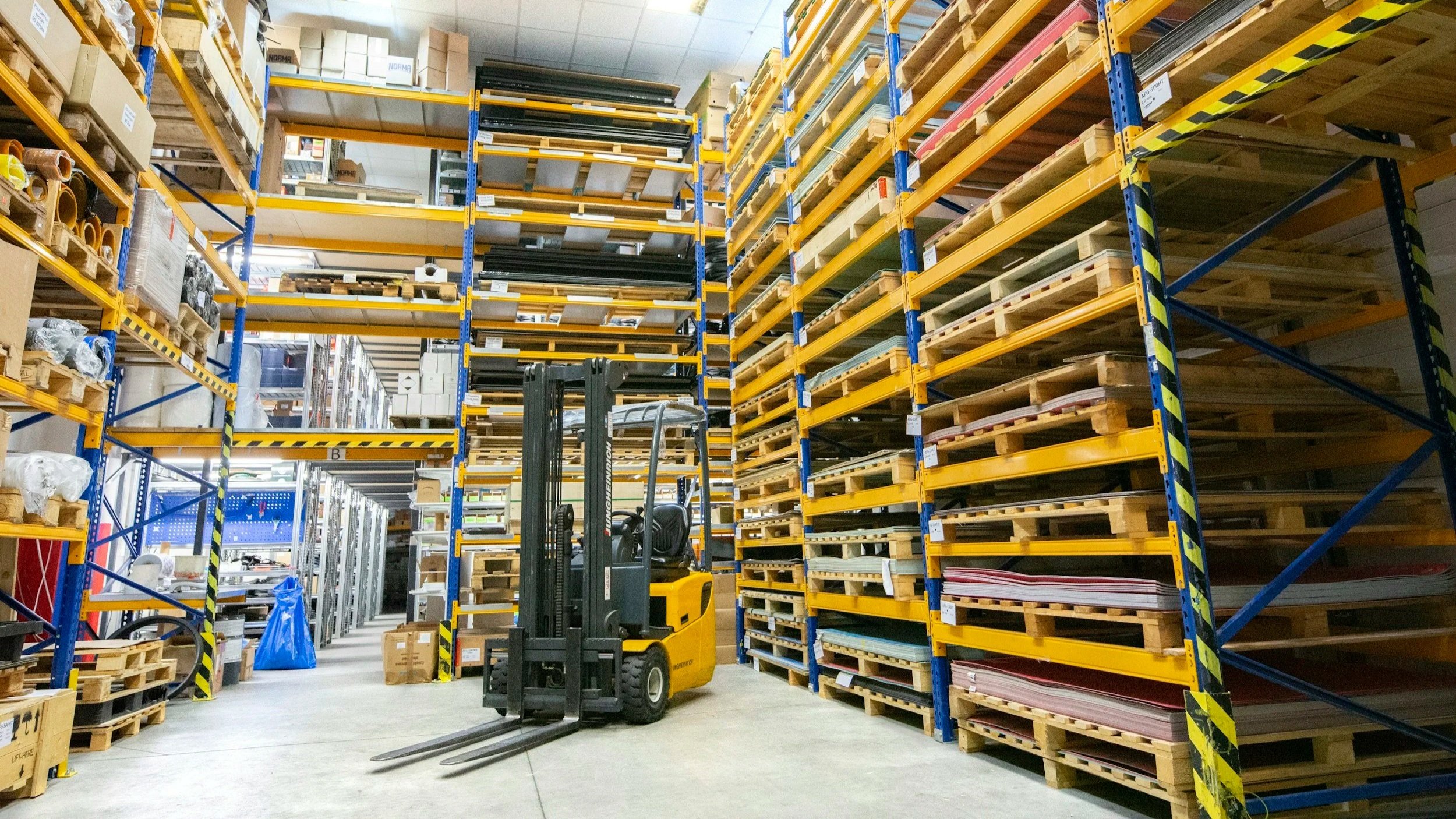

When equipment breaks down, growth opportunities appear, or better gear becomes available, speed matters. CASEY helps Australian businesses access equipment finance without unnecessary delays, confusion or friction.

Upgrade or replace essential equipment

Preserve cash flow for wages and operating costs

Match repayments to the way your business earns

Finance new or used equipment

Keep projects and operations running without interruption

If it helps your business operate — there’s a good chance we can finance it.

Equipment Finance Options We Compare

Equipment Loan

This is a chattel mortgage.

As described by the major banks.

Simple, flexible repayment structure.

Chattel Mortgage

Most common option.

You own the asset from day one.

Tax benefits (speak to accountant).

Rent-to-Own

Great self-employment solution.

No bank statements required.

Minimal unpaid defaults accepted.

Finance Lease

Own the asset at end of term.

Tax benefits (speak to accountant).

Simple application process.

Who Equipment Finance Is Perfect For

Suits businesses that want to:

✔︎ Preserve cash flow

✔︎ Upgrade, replace, or expand equipment

✔︎ Take on bigger jobs

✔︎ Reduce downtime

✔︎ Improve productivity

✔︎ Secure competitive supplier pricing

✔︎ Reduce tax burden (accountant advised)

It’s an excellent option for:

✔︎ Trades & construction

✔︎ Manufacturing

✔︎ Transport & logistics

✔︎ Hospitality

✔︎ Retail

✔︎ Healthcare

✔︎ Agriculture

How Equipment Finance Works

1. Tell us what you need

Share your equipment type, cost, and supplier quote.

2. We compare 40+ lenders

We match you with lenders most likely to approve you with the best structure.

3. Pick up or receive your equipment

Get approved, pay the suppliers, and pick up the equipment - simple.

What You Can Finance

We specialise in general, specialist, and tertiary equipment — including assets banks typically decline.

Equipment examples:

✔︎ Construction & Trades

Excavators, skid steers, lifts, compressors.

✔︎ Transport

Utes, vans, rigid trucks, trailers, prime movers!

✔︎ Hospitality

Combi ovens, fridges, kitchen equipment.

✔︎ Manufacturing

CNC machines, lathes, lasers, cutting tables.

✔︎ Medical & Technology

Dental chairs, imaging, diagnostic tools.

If it helps produce income, we can usually finance it.

Why Business Owners Choose Casey Asset Finance

Fast Approvals

40+ Lenders

We know the lenders who move fast - turn 5 days into 24 hours!

To find the most competitive structure for your situation.

You work with a broker specialising in business structuring.

No call centres or wait times. You get direct access.

Direct Support

Expert Support

How We Help You Get the Best Result

✔︎ We present your application the way lenders want to see it

✔︎ We highlight your strengths (turnover, contracts, work on hand)

✔︎ We identify lenders who specialise in your industry

✔︎ We find the right structure, rates, and early payout options

✔︎ We avoid lenders who avoid funding or decline your industry

✔︎ We help you understand all costs before you proceed

✔︎ We support you after settlement for upgrades or future equipment

Frequently Asked Questions

-

Yes. Many lenders assess your cash flow and business performance rather than your credit score.

-

Rarely. Many lenders offer low doc equipment finance using bank statements or BAS.

-

Many approvals occur within hours. High-value or specialist assets may take longer.

-

Yes — there are lenders who assess the asset, turnover, and overall business strength.

-

Often no. Low or no-deposit options are available depending on the asset and profile.

-

Yes — some lenders accept new ABNs for selected assets.

Compare Business Loan Types

✔︎ Equipment Finance — you are here

✔︎ Unsecured Business Loans

✔︎ Business Line of Credit

✔︎ Bad Credit Business Loans

✔︎ Rent-to-Own

✔︎ Truck Finance

✔︎ Low Doc Business Loans

Ready to Finance Your Next Piece of Equipment?

Get a free, no-obligation assessment

100% free · No credit score impact · No obligation