Blog

This blog shares general information to help business owners understand common business finance topics, terms, and considerations.

The articles here are educational only. They are not personalised advice and may not reflect what is suitable for your business or circumstances.

If you’re actively considering finance or need guidance specific to your situation, the most direct next step is to review the relevant service page or check eligibility.

What this page will not cover

This blog does not assess eligibility, recommend products, provide approvals, or outline timeframes.

Asset Based Loan “Restart Funding”: Use Unused Assets to Consolidate Daily Repayment Debt

Daily repayments can crush cash flow. If you own a high-value unused asset, an asset based loan may help you consolidate debts and reset.

Unsecured vs Secured Business Loans: What’s the Difference?

Choosing the right type of business loan can open new doors for growth — but do you really know the difference between secured and unsecured finance?

We break it down in plain English so you can protect your assets, save time, and make a confident decision for your business.

Debtor Cash Lines Explained: The Flexible, Undisclosed Alternative to Invoice Finance

Many businesses rely on customer invoices for cash flow — but waiting to get paid can slow everything down. A Debtor Cash Line gives you flexible, undisclosed access to working capital without the complexity of traditional invoice finance. Learn how it works, who it suits, and how it fits within Commercial Distribution Finance in Australia.

How Wholesale and Distribution Businesses Use a Line of Credit to Keep Cash Flow Moving

Wholesalers often face cash flow gaps between supplier payments and customer invoices. A business line of credit helps you access cash exactly when you need it — so you can buy stock, cover expenses, and keep operations running smoothly without reapplying for new loans. Learn how it works and how to qualify in Australia.

What Is Commercial Distribution Finance?

Commercial distribution finance helps businesses buy stock from suppliers without paying upfront, then pay it back as stock sells and customers pay. This guide explains how it works, who it suits, and what to do if your bank (or a specialist funder) has said no. If you want to explore options, use Check Eligibility (30 sec).

Why So Many Business Owners Get Stuck After a Decline — and How to Finally Move Forward

You’ve tried the bank. You’ve tried a lender. Maybe even a broker. Yet you still don’t have the funding you were promised. This post breaks down what really goes wrong behind those declines — and how smart business owners turn frustration into fast approvals without risking their credit score.

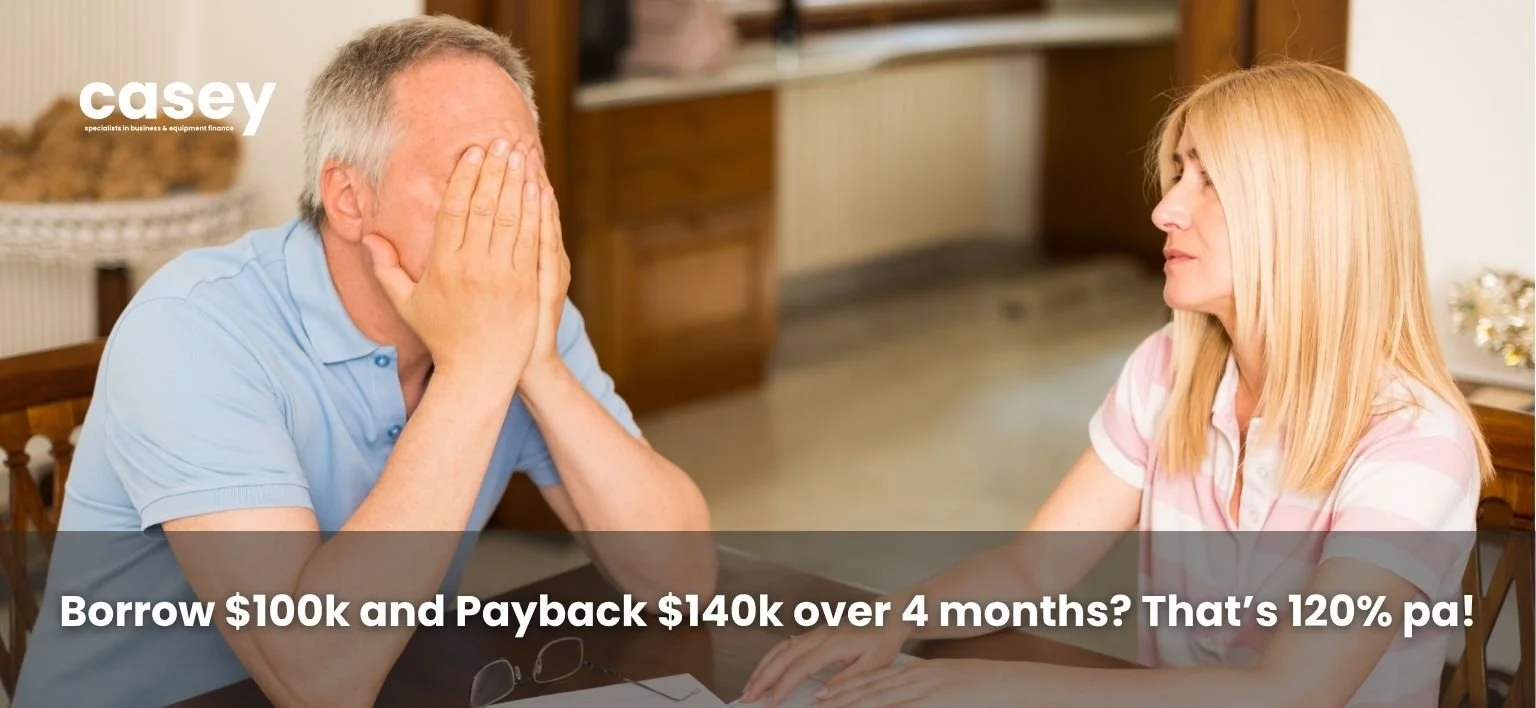

Offered a 1.4 Factor-Rate Short-Term Business Loan? Read This Before You Sign

Got a 1.4 factor-rate quote for 6 months? Don’t lock it in yet. See cheaper, longer-term options from 40+ short-term business loan lenders (incl. Bizcap, TruCap, SkyeCap, Capify, BizFund, AuzCap). Send your quote for a same-day second opinion—with fewer credit hits.

Quick Caveat Loans in Australia: What You Must Know Before You Risk Your Property

A fast caveat loan can solve a cash crunch—or cost you your home. Here’s the truth about timelines, costs, risks and safer alternatives in Australia.

Business Loan Broker (Australia): Compare 40+ Lenders & Get Approved Faster

Time-poor and careful with your credit score? Compare 40+ business loan lenders with one broker. Soft checks first, one hard enquiry only when you’re ready. Fast approvals, Australia-wide.

Director Penalty Notice (DPN): Why Acting Early Matters (and What To Do Next)

Received a DPN? Learn what’s at risk, what to do in the next 48 hours, and how ATO debt solutions can work — in plain English.

Are Business Loans Tax-Deductible?

Stop overpaying tax. See exactly which business-loan costs the ATO lets you deduct in 2025—and the traps that trip up most owners.

Moula Finance review: who it suits and how to double-check fit

Banks said no? Discover how Moula funded a Melbourne cafe in 24 hrs $10k-$250k unsecured and why broker-packaged deals win cleaner credit files and faster approvals. Full 3-minute review inside.

ATO Debt Refinance: A Simple Guide When Repayments Feel Too Much

ATO debt often feels impossible because repayments are too big. This simple guide explains refinance options, terms and when it can add risk.

Why Smart Business Owners Avoid Direct Lenders — And What to Do Instead

Applying directly to a lender? It could cost you thousands. Learn what banks won’t tell you — and how to protect your cash flow and credit.

Tasmania’s Business Growth Loan Scheme: Everything You Need to Know (And What to Do If You’ve Been Declined)

Tasmanian business owner? Learn what to do if you’re declined for the Business Growth Loan Scheme — plus faster funding options with less red tape.

Top 10 Must-Have Hospitality Equipment Items – And How to Finance Them Smartly in 2025

Buying new equipment for your hospitality business? Discover the 10 most searched items in 2025—and how to finance them smarter, not harder.

Instant Asset Write Off 2024 & 2025: What Australian Small Businesses Need to Know

EOFY alert: The $20K Instant Asset Write-Off ends June 30. If you’re buying tools, equipment or vehicles for your business—this guide could save you thousands.

ATO Tax Debt Changes from July 1, 2025: What Australian Businesses Need to Know

From July 1, ATO tax debt gets more expensive. The interest is no longer tax deductible—and debt recovery is ramping up. Here’s what every business owner needs to know before it’s too late.

What’s the Difference Between an Asset Finance Broker and a Business Finance Broker?

Not all brokers are created equal. If you’re a business owner, this is the post that could save you from costly loan mistakes and help you secure smarter, longer-term funding.

How to Escape High-Interest Business Loans in 2025

Drowning in daily repayments? You’re not alone—and you’re not stuck. Discover real strategies to break free from high-interest business loans in 2025.