Blog

This blog shares general information to help business owners understand common business finance topics, terms, and considerations.

The articles here are educational only. They are not personalised advice and may not reflect what is suitable for your business or circumstances.

If you’re actively considering finance or need guidance specific to your situation, the most direct next step is to review the relevant service page or check eligibility.

What this page will not cover

This blog does not assess eligibility, recommend products, provide approvals, or outline timeframes.

ATO Debt Refinance: Stop Penalties. Breathe Again in Days.

ATO on your back? Refinance ATO debt in 24–72 hrs and swap penalties for one fixed repayment. We’re brokers, not accountants—speak to yours, then call Michael.

Business Line of Credit After a Bank Decline — 2025 Guide for Hospitality, Retail & Beyond

Bank stalled or declined your café or shop? See how Aussie owners secure a business line of credit in 48 hrs—costs, steps, and tips.

Why Smart Business Owners Avoid Direct Lenders — And What to Do Instead

Applying directly to a lender? It could cost you thousands. Learn what banks won’t tell you — and how to protect your cash flow and credit.

Tasmania’s Business Growth Loan Scheme: Everything You Need to Know (And What to Do If You’ve Been Declined)

Tasmanian business owner? Learn what to do if you’re declined for the Business Growth Loan Scheme — plus faster funding options with less red tape.

Top 10 Must-Have Hospitality Equipment Items – And How to Finance Them Smartly in 2025

Buying new equipment for your hospitality business? Discover the 10 most searched items in 2025—and how to finance them smarter, not harder.

Instant Asset Write Off 2024 & 2025: What Australian Small Businesses Need to Know

EOFY alert: The $20K Instant Asset Write-Off ends June 30. If you’re buying tools, equipment or vehicles for your business—this guide could save you thousands.

ATO Tax Debt Changes from July 1, 2025: What Australian Businesses Need to Know

From July 1, ATO tax debt gets more expensive. The interest is no longer tax deductible—and debt recovery is ramping up. Here’s what every business owner needs to know before it’s too late.

What’s the Difference Between an Asset Finance Broker and a Business Finance Broker?

Not all brokers are created equal. If you’re a business owner, this is the post that could save you from costly loan mistakes and help you secure smarter, longer-term funding.

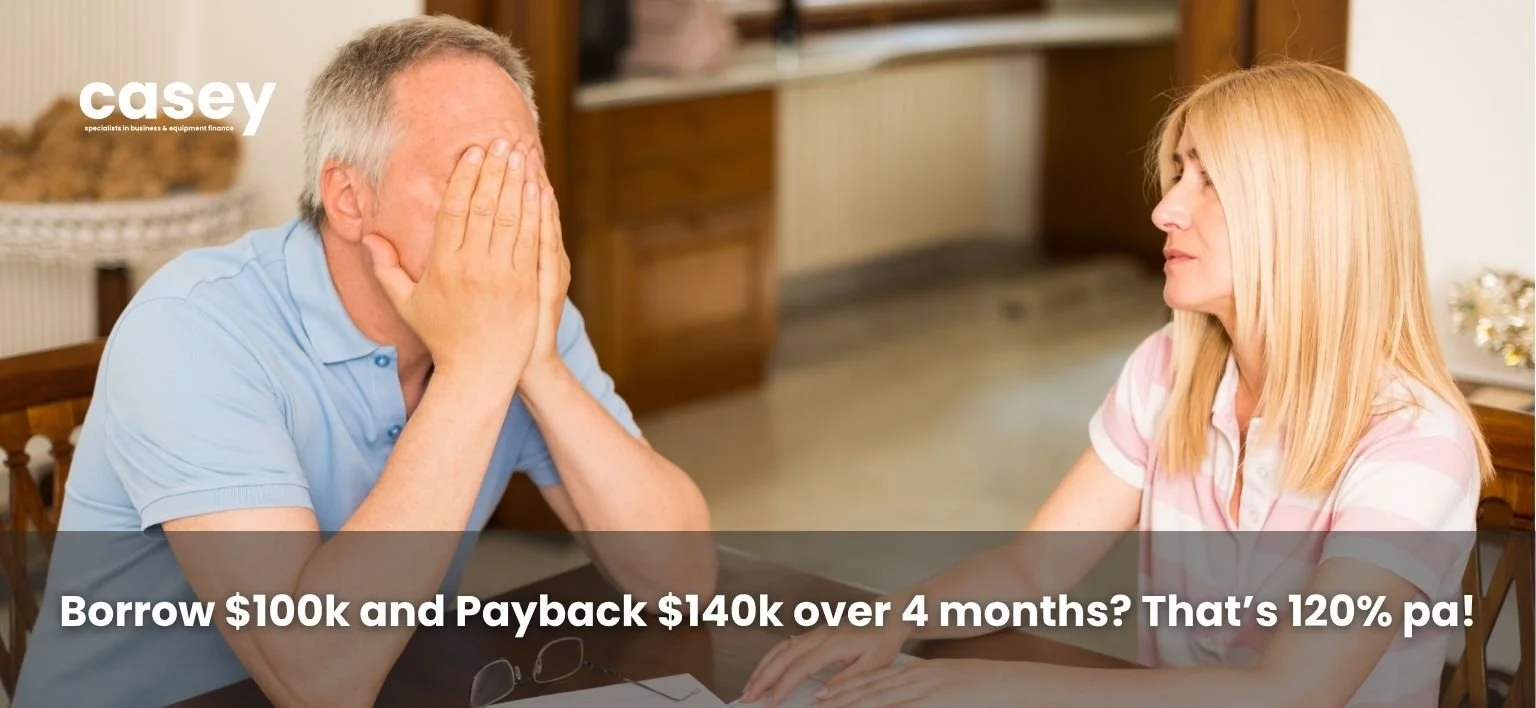

How to Escape High-Interest Business Loans in 2025

Drowning in daily repayments? You’re not alone—and you’re not stuck. Discover real strategies to break free from high-interest business loans in 2025.

EOFY 2025: Slash Tax & Upgrade Gear with Equipment Finance

EOFY coming fast? Slash tax and upgrade gear with fast finance. No financials needed — just your ABN. Start in 60 seconds.

Prospa Business Loans Review 2025: Rates, Fees, Pros

Before you apply for a Prospa loan, read this. We break down the truth about rates, repayments, and better alternatives most business owners aren’t told about.

Quick Business Loans Online: How to Get Approved Fast in 2025

Bank said no? You’re not alone. Discover how Aussie businesses get approved fast online—no property, no pressure, just clarity.

Equipment Loans for Small Business in Australia: How to Get Approved in 2025 Without Slowing Down Your Growth

Need new gear for your business in 2025? Get equipment loans from 6.49%—approved in 24–48hrs with no financials. Learn how to qualify.

The 2025 Australian Election: What It Really Means for Small Business Owners

Worried about what this election means for your business? This expert guide compares Labor vs Coalition policies—from tax relief to asset write-offs.

Behind on BAS or Tax Returns? Here’s the Smartest Way to Finance Your Hospitality Equipment

Behind on tax returns? Discover smart financing options tailored for hospitality businesses to keep operations running smoothly.

Expanding Your Hospitality Venue Before EOFY? Here’s How to Finance Your Fit-Out Fast

Opening a new hospitality venue? Get up to $75K approved in 24 hrs and claim your EOFY deduction before June 30 — no financials required.

EOFY Business Finance Checklist 2025

EOFY doesn’t have to be a rush. Learn the five key finance moves that smart Australian businesses are making before June 30 — and how to make them easy.

3 Common Mistakes Specialty Café Owners Keep Making (That Are Costing Them Big Money)

Is your café making one of these 3 costly mistakes? Discover what’s really holding your business back—and how to fix it before it bleeds your profits. Written by Glenn Low.

ATO Payment Plan Changes from 1 July: What Business Owners Need to Know

Big ATO changes are coming on July 1. Learn how the loss of tax-deductible interest impacts payment plans — and what you can do instead.

Business Loan Declined? Here’s What It Actually Means (And What to Do Next)

Loan declined? Don’t panic. Learn why it happened, what lenders really look for, and how to get approved faster next time—without the guesswork.